Dominik Konold

- Home /

- Authors | Incentrium /

- Dominik Konold

Dominik Konold

Dominik Konold, with a degree in economics, is the CEO and founder of Findiy, focusing on bank planning, control, and corporate customer support in share-based payment and treasury accounting. Before Findiy, he spent over 13 years at WTS Advisory (formerly FAS AG) as a partner, gaining initial experience in audit and investment banking. Konold studied economics at the University of Ulm and the University of Toronto. Since 2016, he’s been a certified Professional Risk Manager (PRMIA) and also lectures for the Association of Public Banks and the Academy of International Accounting.

Case Studies and Success Stories

Google’s Stock Option Program Google’s Stock Option Program Google (now part of Alphabet Inc.

Step-by-step guide to Stock Option Plans

1. Define Objectives 1. Define Objectives Determine the primary objectives for implementing the stock option plan, such as aligning employee interests, enhancing retention, or succession planning.

IFRS 2 Basics

IFRS 2 vs. IAS 19 (other employee benefits) IFRS 2 vs.

ESOP Introduction

Definition Definition ESOP, also known as share based compensation, involves employees receiving portion of their pay in company shares or related instruments.

Share-based compensation: Introduction

Definition Definition Share-based compensation, also known as ESOP, involves employees receiving portion of their pay in company shares or related instruments.

Management & Administration

Record keeping Record keeping Accurate record-keeping is essential in ESOP management.

ESOP Types | Incentrium

Employee Stock Option Program (ESOP) Employee Stock Option Program (ESOP) An Employee Stock Option Plan (ESOP) offers the choice to purchase actual shares at a predetermined, often discounted price.

ESOP features

ESOP grants ESOP grants Within ESOP features like the number of stock options or more generally instruments granted to eligible employees are specified.

ESOP valuation issues

ESOP valuation model ESOP valuation model Background A crucial point in ESOP valuation in accordance with IFRS 2 and ASC 718 is the selection of a valuation model.

VSOP vs. ESOP

VSOP Definition VSOP Definition A Virtual Stock Option Plan (VSOP) serves as an employee incentive, simulating stock options (ESOP) without the grant of any company equity.

ESOP accounting issues

Grant date according to ASC 718 and IFRS 2 Grant date according to ASC 718 and IFRS 2 ASC 718 and IFRS 2 Background Under IFRS 2 and ASC 718, share-based payment agreements must be measured on the measurement date.

Leaver provisions

Good leaver Good leaver A good leaver is typically an employee who leaves the company under favorable circumstances.

RSU vs. ESOP

RSU Granting and ownership RSU Granting and ownership RSU When the company grants an employee equity-settled RSUs, the employee receives a promise to obtain a specific number of company shares in the future.

Trustees and Administrators

In summary, trustees and administrators play complementary roles in the management and operation of Employee Stock Option Programs.

Legal & Regulatory Framework

Taxation Taxation Tax treatment for employees The tax treatment of ESOPs for employees can vary widely.

Reasons for ESOP

Aligning Interests Aligning Interests ESOPs align the interests of employees with those of the company.

Incentrium compared

The challenge The challenge Selecting the right software for Employee Stock Ownership Plan (ESOP) management is a pivotal decision for businesses, with far-reaching implications.

Cheat Sheet

Download Cheat Sheet

Equity Evolution: Transforming the Future of Work

The future of work as we know it is shifting radically in new directions.

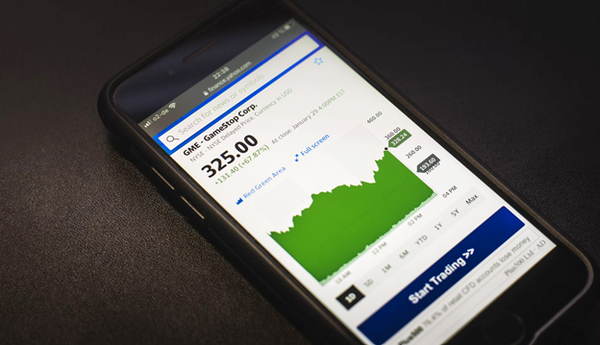

Share-based compensation: Challenges for startups

Share-based compensation is standard practice for most publicly traded companies when it comes to retaining employees and attracting talent.

Equity settled vs. cash settled SBC

Equity settled and cash-settled share-based compensation each have their own advantages and disadvantages.

ChatGPT is on everyone's lips...

At Incentrium we always ask ourselves how we can further enhance the services and usability of our Software using exciting new advancements.